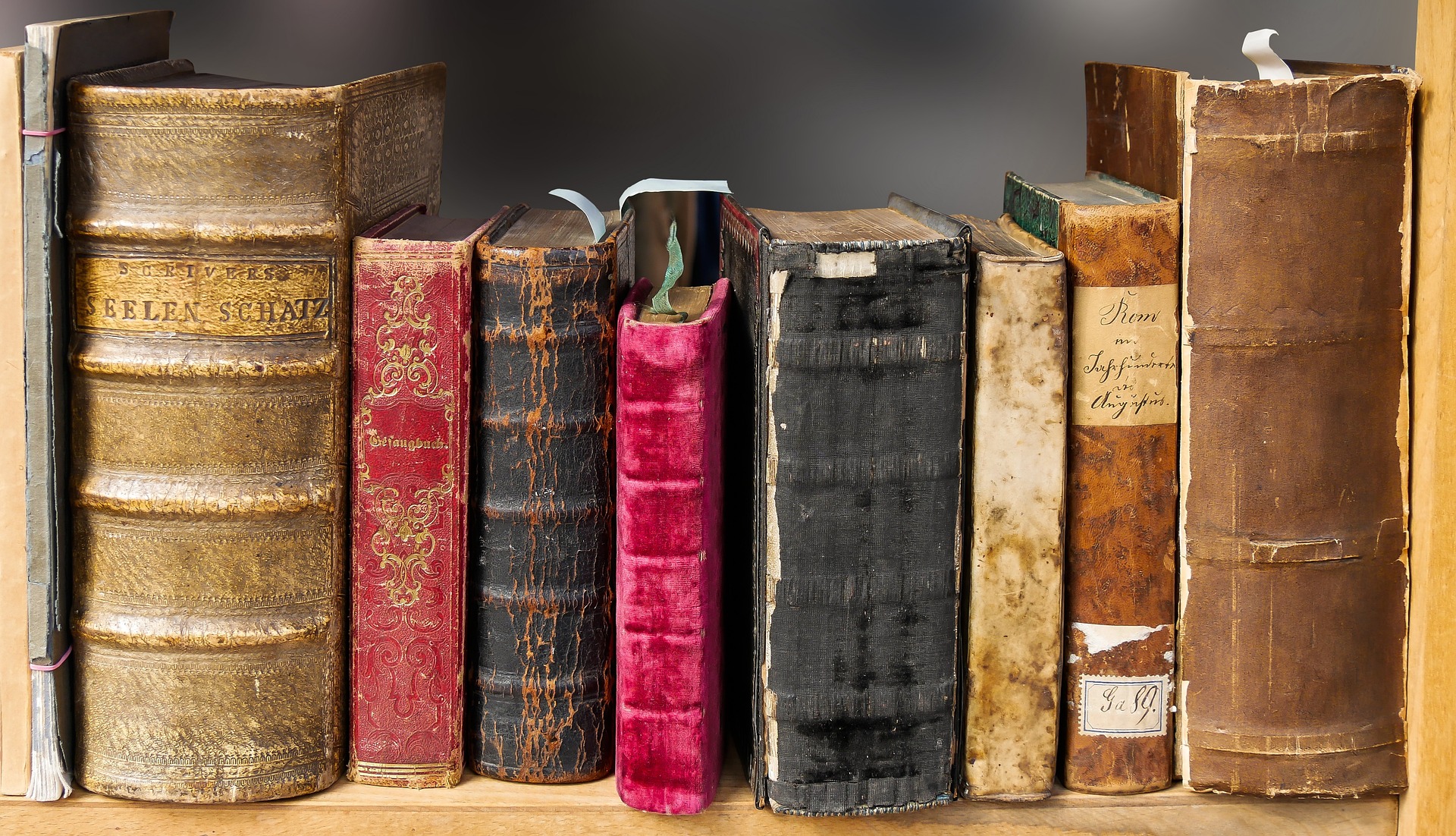

Investing in rare books is a niche market that has been around for centuries. Unlike stocks and other traditional investments, rare books can offer unique value propositions, such as historical significance and scarcity. However, there are also risks and challenges involved in investing in rare books. In this blog post, we’ll explore how to invest in rare books, as well as the pros and cons of this type of investment.

How to Invest in Rare Books

- Do Your Research: Before investing in any rare book, it’s important to conduct thorough research to ensure that you’re making a sound investment. Look for books that are in high demand, have limited supply, and are in excellent condition. This will require a lot of digging, but the payoff can be worth it.

- Build Relationships: Invest in relationships with reputable dealers and collectors. Attend book fairs and auctions to meet other collectors and dealers who can help you learn more about rare books and their value.

- Understand Grading and Valuation: The condition of a rare book plays a significant role in its value. Learn how books are graded and valued, so you can make informed decisions about purchasing or selling.

- Set a Budget: Investing in rare books can be expensive. Set a budget and stick to it to avoid overspending.

- Consider Diversification: Diversify your rare book investments by buying books from different time periods, genres, and authors. This can help mitigate the risks associated with investing in a single book or author.

Pros of Investing in Rare Books

- Tangible Assets: Rare books are physical assets that can be held, displayed, and enjoyed. Unlike stocks, bonds, or cryptocurrencies, rare books have a physical presence and can be passed down as heirlooms.

- Historical Significance: Many rare books have historical significance, which adds to their value. Collectors may be interested in books that played a significant role in literature, politics, or science.

- Potential for Appreciation: Rare books can appreciate over time, especially if they are in excellent condition or become more popular due to changing tastes or trends.

Cons of Investing in Rare Books

- High Risk: Rare books are a niche investment, which means they may not be as liquid as traditional investments. This can make them more difficult to sell, especially if the market for rare books is in a downturn.

- Limited Market: The market for rare books is relatively small compared to other investments. This can make it challenging to find buyers or sellers at the right price.

- Maintenance Costs: Rare books require proper storage and maintenance to preserve their condition. This can be costly, especially if you have a large collection.

In conclusion, investing in rare books can be a rewarding and exciting experience for those who have a passion for literature and history. However, it’s important to do your due diligence and understand the risks and challenges involved in this type of investment. With the right research, relationships, and diversification, investing in rare books can be a lucrative and enjoyable experience.