Celebrities

Willem-Alexander of the Netherlands: Navigating the Challenges of Modern Monarchy

Willem-Alexander, born Willem-Alexander Claus George Ferdinand on April 27, 1967, is the reigning monarch of the Netherlands. Ascending to the throne on April 30, 2013, [more…]

Albert II of Belgium: A Sovereign’s Journey through Turbulent Times

Albert II, born Albert Félix Humbert Théodore Christian Eugène Marie in Brussels on June 6, 1934, is a pivotal figure in the modern history of [more…]

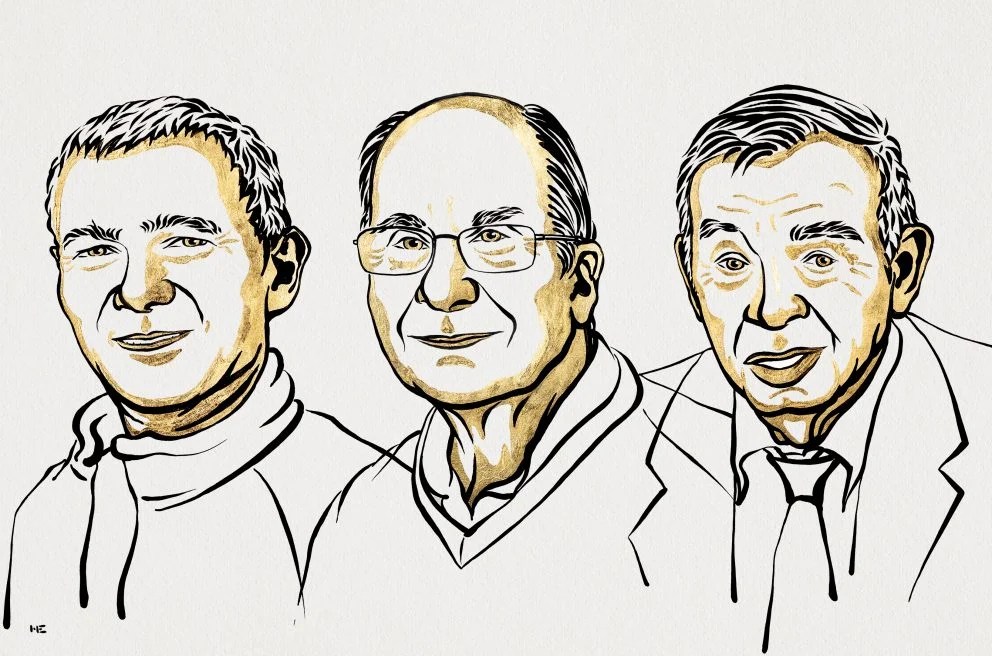

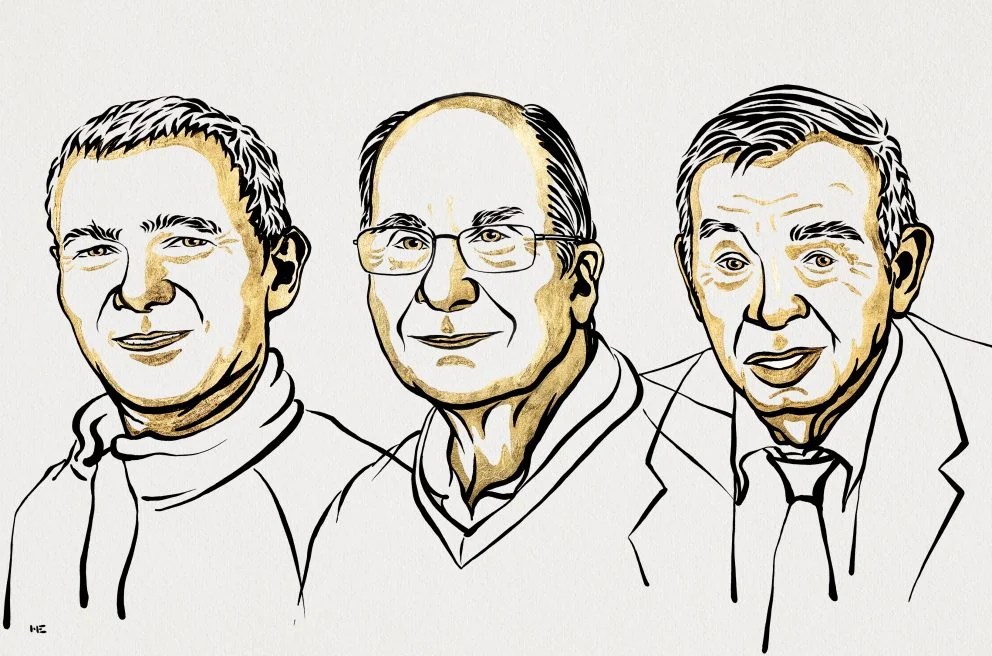

Moungi Bawendi: Illuminating the World of Quantum Dotsd of Quantum Dots

Moungi Bawendi: Illuminating the World of Quantum Dots

Moungi Bawendi: Illuminating the World of Quantum Dots

Moungi Bawendi, a luminary in the field of chemistry, has left an indelible mark on the world of nanoscience through his groundbreaking work on semiconductor [more…]

Alexey L. Pajitnov - The Father of Tetris

Alexey L. Pajitnov, the brilliant mind behind Tetris, one of the most iconic and enduring video games of all time, has left an indelible mark [more…]

Sam Altman: Pioneering the Future with OpenAI’s GPT

Who is Sam Altman, and from which educational institution did he graduate? What is Sam Altman’s net worth? Early Life and Education Altman was born [more…]

Agit Kabayel - The German Boxing Sensation

Early Life and Background:Agit Kabayel was born on February 23, 1992, in Cologne, Germany. He grew up in a working-class family of Turkish descent. From [more…]

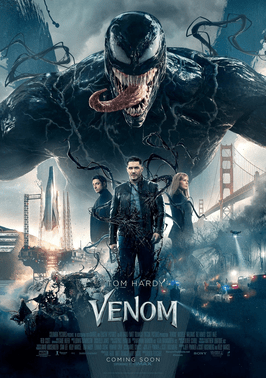

Unleashing Venom: The Creative Genius of Todd McFarlane in Redefining a Comic Book Villain

Few collaborations in the comics world have been as influential as the creation of Todd McFarlane and Venom. Together, they breathed new life into the [more…]

Hajime Isayama Books Titans: Exploring the Impact of his Iconic Manga

In the vast world of manga, few names resonate as strongly as Hajime Isayama. With his groundbreaking Attack on Titan series, Isayama-sensei gained international recognition [more…]